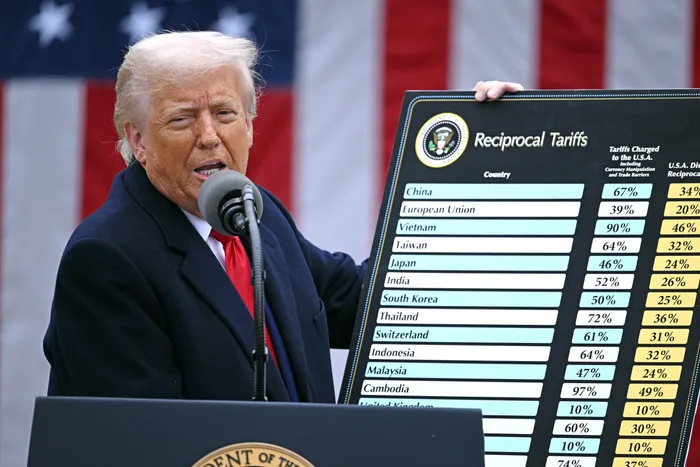

US President Donald Trump holds a chart on reciprocal tariffs. A major Federal Appeals Court ruling against Trump’s signature tariff policy has injected significant new uncertainty into US trade policy.

Image: Brendan Smialowski/AFP

THE global economy is entering a period of significantly slower growth, buffeted by new US tariffs, rising protectionism, and legal challenges, but is likely to avoid an outright recession due to strong corporate fundamentals and supportive fiscal policies, according to new analyses from Oxford Economics and the deVere Group.

In a comprehensive assessment this week, Ben May, Director of Global Macro Research at Oxford Economics, argued that while the impact of tariffs would be felt, it would be “muted and mitigated” by government spending, setting the stage for a prolonged era of economic fragility rather than a sharp collapse.

“Despite the huge uncertainty created by US tariffs, there’s a growing sense that the global economy and financial markets may be able to live with them,” May said. “Overall, we expect that the broad impact of higher tariffs on the global economy will be muted and mitigated by supportive fiscal — and to a lesser degree monetary — policy, especially in the US and China.”

This view is underscored by formidable data on the resilience of the US economy. US corporate earnings demonstrated remarkable strength, with the S&P 500 reporting year-on-year earnings growth of more than 9% in Q2 2025.

Over three-quarters of companies surpassed Wall Street estimates. The macroeconomic landscape provides an equally sturdy foundation, with US GDP expanding at an annualised rate of 2.8% in the second quarter and unemployment remaining under 4%.

The primary channel for economic dampening, however, is business investment, hampered by policy and legal uncertainty. A major Federal Appeals Court ruling against US President Donald Trump’s signature tariff policy has injected significant new uncertainty into US trade policy.

According to Nigel Green, the chief executive of deVere Group, this legal drama is a “distraction” for investors. “This ruling highlights a serious legal threat to one of the President’s most high-profile economic policies. But investors should not let themselves get distracted by courtroom drama. What ultimately matters for markets are the fundamentals, and those remain solid.”

Echoing the sentiment of persistent uncertainty, May explained that forecasting the impact is difficult. “Given the unprecedented nature of the shock, it’s difficult to pinpoint the likely hit to investment with precision.” His firm’s latest forecasts assume “that the level of US business investment will be around 5% lower in 2026 than we had assumed on the eve of the US presidential election”, a trend expected to ripple through other major advanced economies.

May remained cautious that any recent trade deals would only provide a temporary reprieve. “The tariff deals struck might lead to some near-term calm, but they don’t rule out the possibility of future tariff threats or actual hikes. The odds are stacked in favour of additional tariffs.”

Green concurred that the administration’s trade goals are persistent. “Even if the tariffs are struck down, we believe the Trump administration will look for new ways to tax imports … It would be naïve to assume this White House will simply abandon such a significant fiscal lever.”

A critical reason experts do not foresee a recession is the expected resilience of the consumer, ongoing government support, and powerful corporate earnings.

May noted that the squeeze on US real incomes would slow growth rather than turn it negative, and “real household income growth in the US is expected to prove more resilient than in other advanced economies”. Furthermore, he expected governments to run large fiscal deficits to support growth. “We think fiscal policy will start to support US GDP growth in late 2025 and 2026 after the soft H1. So, we expect US economic exceptionalism to reassert itself next year.”

Crucially, he does not anticipate widespread job cuts. “We assume any rises in unemployment will be modest … the environment may be tough for those without a job to find employment, but not necessarily soft enough to make those with work fearful of retaining their job.”

This strength is evident in corporate performance. Tech giants continue to lead the charge, with Apple’s net income climbing 17%, Microsoft delivering a 21% jump in cloud revenue, and Amazon reporting a 22% increase in quarterly earnings. The strength extends beyond tech, and even consumer-facing companies like McDonald’s and Starbucks both beat consensus forecasts, powered by sustained consumer spending.

“Corporate America continues to show that it can grow earnings and sustain profitability even under an unpredictable policy regime,” Green said. “These are the signals serious investors should be paying attention to, not short-term headlines about court rulings.”

Looking beyond the immediate policy shock, May outlined a fundamental shift in the global economic landscape towards a more volatile future. “More volatile inflation, higher risks of policy mistakes, and slightly slower trend growth increase the likelihood of shorter expansionary periods than seen during the 1990s and early 2000s,” he said. “Perhaps even signalling a return to the stop-start cycles of the pre-inflation targeting era.”

This new reality will be characterised by more activist fiscal policy and persistent trade pressures. “The shift in the global trade order caused by Trump’s tariffs is likely to drag global trade as a share of GDP lower,” May said, adding that given a growing “bipartisan protectionist consensus, high tariffs seem likely here to stay.”

For investors, the strategy remains to see beyond the turbulence. Green advised, “We urge investors not to get caught in the noise. Keep your eyes fixed on quality names with strong balance sheets, durable earnings streams, and global reach.”

He stresses that “markets will always have political and legal dramas. But wealth is built by those who can see beyond them to the real drivers of returns. Fundamentals must remain the compass”.